An Unbiased View of Feie Calculator

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.The 3-Minute Rule for Feie CalculatorTop Guidelines Of Feie CalculatorThe Feie Calculator PDFsIndicators on Feie Calculator You Need To KnowFeie Calculator for DummiesThe Greatest Guide To Feie Calculator

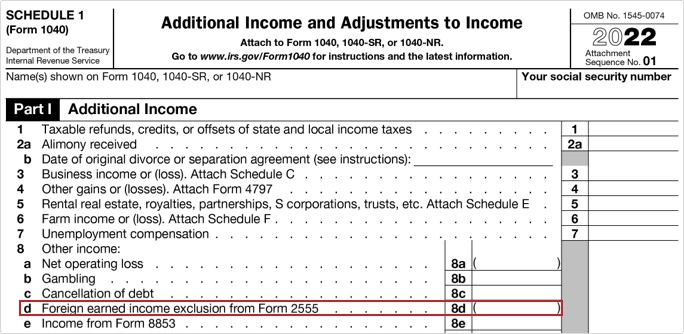

If he 'd frequently traveled, he would certainly instead complete Part III, listing the 12-month period he satisfied the Physical Visibility Test and his travel history. Action 3: Coverage Foreign Income (Part IV): Mark earned 4,500 per month (54,000 annually).Mark calculates the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percentage of time he stayed abroad throughout the tax obligation is 100% and he enters $59,400 as his FEIE. Mark reports total wages on his Kind 1040 and gets in the FEIE as an adverse quantity on Set up 1, Line 8d, lowering his taxable income.

Selecting the FEIE when it's not the very best alternative: The FEIE might not be excellent if you have a high unearned income, earn greater than the exclusion limit, or stay in a high-tax country where the Foreign Tax Obligation Credit Rating (FTC) might be extra beneficial. The Foreign Tax Obligation Credit Report (FTC) is a tax obligation decrease approach frequently used combined with the FEIE.

The 20-Second Trick For Feie Calculator

expats to counter their united state tax obligation financial debt with foreign income taxes paid on a dollar-for-dollar decrease basis. This indicates that in high-tax countries, the FTC can commonly remove U.S. tax obligation financial obligation completely. The FTC has limitations on qualified tax obligations and the optimum insurance claim quantity: Qualified taxes: Only income taxes (or taxes in lieu of income tax obligations) paid to foreign governments are eligible (Taxes for American Expats).

tax liability on your foreign revenue. If the foreign tax obligations you paid surpass this limitation, the excess international tax can usually be continued for up to 10 years or returned one year (through a modified return). Maintaining precise records of international income and taxes paid is therefore crucial to computing the appropriate FTC and keeping tax conformity.

expatriates to minimize their tax obligation responsibilities. If a United state taxpayer has $250,000 in foreign-earned income, they can leave out up to $130,000 using the FEIE (2025 ). The staying $120,000 might then go through taxes, yet the U.S. taxpayer can possibly use the Foreign Tax Credit history to counter the taxes paid to the international nation.

The Buzz on Feie Calculator

He marketed his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his spouse to aid meet the Bona Fide Residency Examination. Neil directs out that acquiring residential property abroad can be challenging without very first experiencing the area.

"It's something that individuals require to be really thorough about," he claims, and suggests deportees to be mindful of usual blunders, such as overstaying in the U.S.

Neil is careful to stress to Tension tax united state tax obligation "I'm not conducting any performing any kind of Illinois. The U.S. is one of the few countries that taxes its people regardless of where they live, implying that even if an expat has no income from United state

Feie Calculator for Dummies

tax returnTax obligation "The Foreign Tax Credit scores enables people working in high-tax nations like the UK to counter their United state tax liability by the quantity they have actually currently paid in taxes abroad," says Lewis.

The possibility of lower living prices can be alluring, however it frequently comes with compromises that aren't immediately obvious - https://myspace.com/feiecalcu. Housing, for instance, can be more cost effective in some nations, but this can indicate endangering on infrastructure, safety, or access to reputable energies and services. Affordable buildings could be located in areas with inconsistent web, restricted public transport, or undependable healthcare facilitiesfactors that can considerably affect your daily life

Below are some of the most often asked inquiries regarding the FEIE and various other exclusions The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers to exclude as much as $130,000 of foreign-earned earnings from federal income tax obligation, reducing their U.S. tax obligation responsibility. To receive FEIE, you have to fulfill either the Physical Visibility Examination (330 days abroad) or the Bona Fide Residence Test (prove your key house in an international nation for an entire tax year).

The Physical Presence Examination requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Test also calls for united state taxpayers to have both an international earnings and a foreign tax obligation home. A tax home is defined as your prime area for organization or work, despite your family's house. https://gravatar.com/feiecalcu.

The 10-Second Trick For Feie Calculator

A revenue tax obligation treaty in between the united state and an additional nation can help protect against dual taxes. While the Foreign Earned Revenue Exclusion reduces gross income, a treaty may offer additional advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed declare U.S. citizens with over $10,000 in foreign financial accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation advisor on the Harness system and the founder of The Tax Guy. He has more than thirty years of experience and currently focuses on CFO solutions, equity compensation, copyright taxation, cannabis taxes and divorce associated tax/financial planning matters. He is a deportee based in Mexico.

The foreign earned earnings exemptions, sometimes referred to as the Sec. 911 exclusions, omit tax on wages earned from working abroad. The exclusions make up 2 components - a revenue exemption and a real estate exclusion. The following FAQs talk about the benefit of the exclusions consisting of when both spouses are expats in a general manner.

The Best Strategy To Use For Feie Calculator

The tax obligation benefit leaves out the income from tax at lower tax prices. Previously, the exemptions "came off the top" reducing earnings subject to tax obligation at the leading tax prices.

These exemptions do not excuse the salaries from United States navigate to this site taxes but simply provide a tax obligation decrease. Note that a bachelor functioning abroad for every one of 2025 who made concerning $145,000 with no various other income will have gross income lowered to no - properly the same response as being "tax obligation totally free." The exclusions are computed daily.

If you attended company meetings or workshops in the United States while living abroad, earnings for those days can not be left out. Your salaries can be paid in the United States or abroad. Your company's area or the place where wages are paid are not aspects in qualifying for the exemptions. Digital Nomad. No. For United States tax it does not matter where you keep your funds - you are taxable on your worldwide earnings as a United States person.